Financial inclusion isn’t always without a doubt a buzzword. It’s a vital step towards an equitable society. What precisely does it suggest? What can small-price ticket size loan, EDI loans, and each day installments which might be equated help to in reaching this objective? Let’s investigate those concepts with the aid by means of Udhyam Learning Foundation. Udhyam Learning Foundation.

Introduction to Financial Inclusion

Financial inclusion refers to imparting economic services at an inexpensive price for every person, and in particular the most deprived. It’s approximately ensuring that everyone irrespective of earnings, could have access to monetary services and products like loans, financial savings and insurance. This can help people control their budget, create property, and decorate their monetary state of affairs.

What are Small Ticket Size Loans?

Small-ticket length loans are low-price loans which might be supposed to meet the desires of financial establishments of people who can be not able to get admission to the traditional banking device. They are usually utilized for personal expenses or small commercial enterprise ventures or for emergency necessities. The accessibility and simplicity of those loans makes them an vital device for encouraging economic inclusion.

The Importance of Small Ticket Loans

Why are small ticket loans so critical? They permit financial get right of entry to for folks who are typically no longer able to get admission to conventional banking establishments due to a lack of collateral and credit heritage. Through imparting loans with smaller quantity, those loans help people set up or amplify small organizations, cover instantaneous expenses, and growth their residing situations.

EDI Loans: A Closer Look

EDI loans, additionally referred to as Equated day by day installment loans are a wonderful type of small-price tag mortgage that permits reimbursement in possible, daily installments. This form of association is specially beneficial for small-scale marketers who perform on ordinary coins waft. This ensures that mortgage payments do not be a burden, allowing the borrowers to concentrate on increasing their business.

Equated Daily Installments (EDI) Explained

Imagine having to pay lower back the loan in complete on the time of the month’s stop. It’s a frightening mission isn’t it? EDI loans split the fee into every day installments which makes it a good deal simpler for the borrower to manipulate their monetary state of affairs. It’s like working at an extensive mountain piece at a while as opposed to trying to conquer the whole lot in one go.

How Udhyam Learning Foundation is Helping

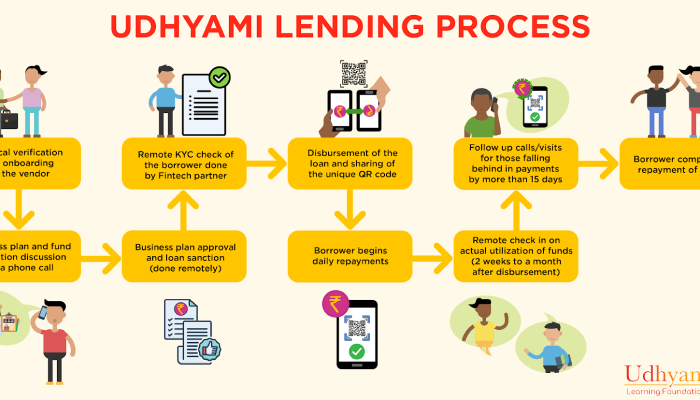

Udhyam Learning Foundation is at the vanguard of monetary inclusion via small-price tag size loans in addition to EDI loans. By presenting statistics, assets, and finance offerings Udhyam aids people and small businesses attain stability of their price range and boom their growth. Their applications empower people to be in control of their financial future.

Benefits of Small Ticket Size Loans

Small-price tag loans can provide many benefits:

Accessibility: The HTML0 accessibility is to be had for those who may not be eligible for traditional loans.

Flexibility: They can be utilized for a whole lot of motives, starting from funding in commercial enterprise to personal requirements.

Manageable Repayments: With options which includes EDI the payments are paid in small and viable quantities.

Monetary independence: It enables borrowers establish credit histories and achieve monetary freedom.

Challenges and Solutions

While loans with small quantities can be beneficial, they also have their personal challenges, which includes excessive rates of hobby and the hazard of a debt that is too high. Udhyam Learning Foundation addresses these problems by providing economic training and help if you want to ensure that borrowers take knowledgeable picks and manipulate their loans prudently.

Case Studies: Real-Life Impact

Think about the story of Rani, a small-sized save owner. With a modest loan from Udhyam the store proprietor became able to boom the size of her inventory in addition to increase her earnings. Another example is Ravi who applied the EDI credit to shop for equipment in his tailoring company. These stories from real lifestyles illustrate the transformational potential of these tools for monetary control.

How to Apply for Small Ticket Size Loans

Making an utility for a smaller size mortgage is straightforward. These are the stairs to follow:

Study: Look for creditors or different groups together with Udhyam which provide those loans.

Documentation: Gather necessary files like ID evidence or proof of deal with, in addition to the commercial enterprise facts.

Application Form: Please fill out this application with complete facts.

Aproval After your request has been accredited and reviewed you will get hold of the quantity of mortgage.

Payback: Follow the reimbursement agenda with care to preserve an tremendous credit rating.

Future of Financial Inclusion

Financial inclusion’s future is promising thanks to new solutions like small-price ticket loans and EDI loans. As more establishments like Udhyam Learning Foundation retain to assist in these efforts We can anticipate to be a more equitable and financially empowered society.

Conclusion

Small-price tag credit, EDI loans, and monetary inclusion pass beyond financial terms, they may be lifelines for a lot of folks who are seeking out a brighter future. With corporations such as Udhyam Learning Foundation main the way we will sit up for a destiny wherein economic offerings are with no trouble available to anybody, assisting human beings to create a better the following day.

FAQs

1. How can we outline monetary inclusion?

It refers to presenting financial offerings at a reasonable cost to everyone, mainly those in want, to enhance their financial situation.

2. What is the first-rate manner to help small price tag size loans inspire monetary access?

These loans supply get admission to to finance for folks who aren’t from traditional banks, supporting the meet enterprise and personal requirements.

3. What exactly are EDI mortgage?

EDI loans are small price ticket-sized loans which can be paid in month-to-month installments, making them viable for small-sized marketers with a each day cash flow.

4. What is the way that Udhyam Learning Foundation help to sell the monetary integration of people?

Udhyam gives schooling, tools, and the ability to get entry to financial help. It empowers small and huge agencies as well as people to achieve financial stability.

5. What are the blessings of loans which can be small in size

They are smooth to get admission to and bendy, they may be repaid comfortably, offer doable installments, and resource in building financial independence.